Industry analysis is one of the fundamental pillars of Equity Research Analysis. Often investors look for tips and tricks to spot a company worth putting their money into. However, with the right balance of fundamental and technical analysis, one can learn how to ride the waves of the market like a pro!

Welcome to yet another read by Leapup that covers the intricacies of Industry Analysis and comprehends different Industry Analysis Methods –

Industry analysis is a process of evaluating an industry to understand the factors that drive it. The factors include but are not limited to market size, the potential for growth, government regulations, key players in the industry, the effect of technology, and identifying what prevails amongst consumers, i.e. consumer trends.

This process helps investors compare companies in that industry, spot risks and opportunities, and make smarter choices.

Imagine planning a tour to Shillong with family and you’ve never been to this place.

What would be the first step? Google the route, weather, and hotel arrangements, or go to a travel booking app to do all the search and analysis for yourself.

Similarly, it is very crucial to understand the external factors that impact your investing journey before putting your hard money in. If you need more reasons why industry analysis matters,

Keep Scrolling 🔽

Valuation is one of the essential stages while performing Equity Research. Do you know the different methods of Valuation? Check here!

Here comes the most awaited section- types of industry analysis.

Okay, so I must tell you- there are plenty of methods to conduct industry analysis- SWOT Analysis, PEST Analysis, Porter’s five forces, Blue Ocean strategy, and many more.

However, in this piece we will discuss the two most popular methods of conducting industry analysis-

Intrigued, Which two are we going to discuss?

Keep Reading!!Before we move further, do you know that Investment banking is one of the most popular careers amongst finance grads? If you’re one of the fellas who wish to grab this Sought-after position? Then check out our latest post!

SWOT Analysis, where the word “SWOT” stands for Strengths, Weaknesses, Opportunities, and Threats, respectively, is one of the fundamental methods used for performing industry analysis.

Strengths: Strengths are those internal factors that give an industry an edge over others, for instance, a strong reputation, an efficient production process, or innovative technology.

Weaknesses: Aspects that make an industry vulnerable come into play here. This could include outdated technology, higher costs of production, poor supply chain management, etc.

Opportunities: Opportunities are those factors that can push the growth charts, and raise profits. Take, for example, any tech advancement, or varying consumer trends if adopted on time in emerging markets could present opportunities in the industry.

Threats: The external factors that can affect a business negatively on profitability, performance, or an overall basis.

SWOT analysis isn’t just limited to industry analysis. It is a versatile tool that can be applied to

various contexts, provide a structured framework for identifying strengths, weaknesses, opportunities, and threats.

By understanding all elements of SWOT, stakeholders/ investors can develop strategies, which can-

Capitalize on Strengths,

Mitigate Weaknesses,

Seize Opportunities,

And lastly, address and guard from possible Threats.

Michael Porter, an American academic, introduced the five forces in his book “Competitive Strategy: Techniques for Analyzing Industries and Competitors” which outlines Porter’s framework for analyzing industry structure and competitive dynamics.

Here are the 5 powers that Porter talked about-

Force 1- “Rivalry with Peers”

The analysis talks about the importance of understanding a company’s position in comparison to its industry peers. This is especially applicable in the case where there is monopolistic competition, i.e. the product differs but not enough to gain a bigger pie in the market share.

Force 2- “Threat of New Competition”:

Industries that offer ease of new players’ entry often face the threat of increased competition. On the other hand, high industry barriers (say energy industry has some regulatory compliances plus requires extensive capital expenditure) often enjoy limited rivalry and thus extended profitability.

Force 3- “Threat of Substitutes”:

Alternate, substitute, replacement – whatever the word used, it means one thing, i.e. the products that can replace each other. If a brand product can be replaced easily, then it doesn’t exist for longer in the industry, which in turn, puts extra pressure on the company to create a differentiator.

Force 4- “Bargaining Power of Buyers”:

Ever heard of the concept Demand is inversely proportional to Supply? If there are a lesser number of buyers than suppliers in the market, i.e. low demand and high supply- it automatically puts pricing power in the buyer’s hand. If a product is expensive the buyers can easily switch to a cheaper option given the high supply.

Force 5- “Bargaining Power of Suppliers”:

In the above pointer, we discussed the situation when buyers have the upper hand. But what about suppliers, when do they get to dominate?

Suppliers hold power in those industries they control essential resources. In such spaces. small and mid-cap entities are quite vulnerable if the big sharks hold significant bargaining power.

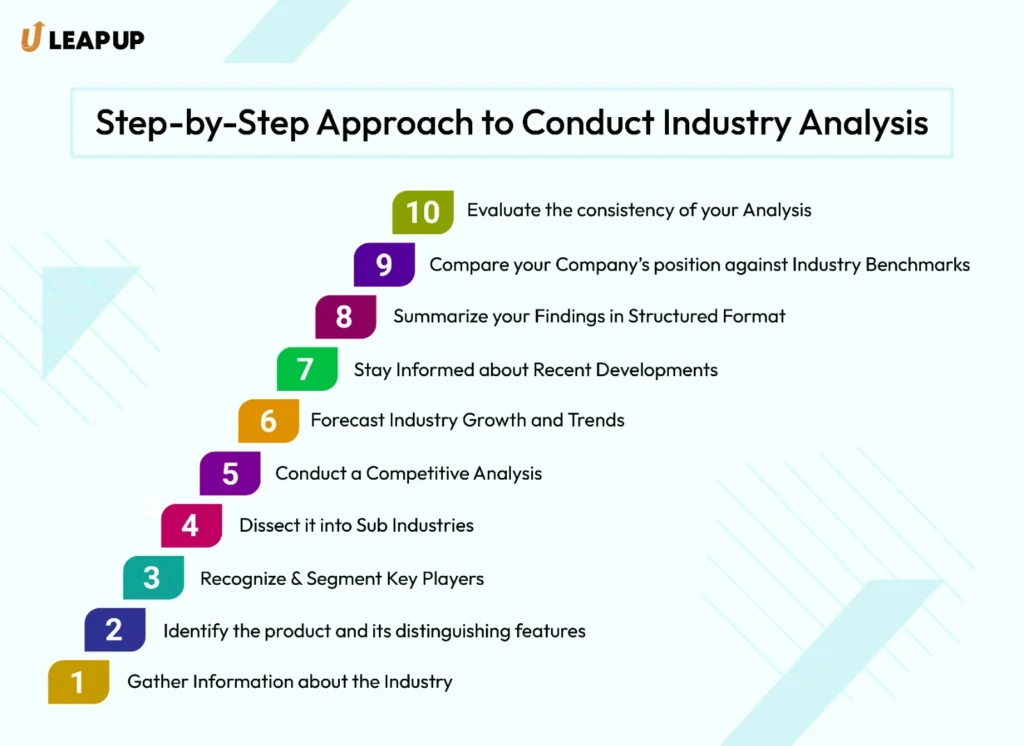

To conduct a comprehensive industry analysis, follow these step-by-step guidelines:

By following these steps, you can conduct a thorough and insightful industry analysis to inform strategic decision-making for your business.

Nothing happens just by staring at the screen. You need to get some first-hand experience with it!

Wondering where to get some practical learning?

Don’t worry, Leapup provides comprehensive Equity research training that covers industry analysis in detail along with relevant tools required to perform fundamental analysis of a company. We’ve got mentors who have been teaching core finance skills to the “ready-to-learn” minds for years.

Like what you read? We have more coming…

The only CFA Training Program that provides complete personalization via 1-on-1 Mentorship & Instant Doubt Solving by qualified faculties.

This program is specially curated for Working Professionals & Students with busy schedules.

Join our Level 2 Online Training and Leapup In Your Core Finance Career.

Appear for 8 CFA mock test level 1 in Computer-Based Testing (CBT) format + solve 30 subjectwise CFA level one practice questions.

Appear for 8 mocks in CBT format to crack your CFA Level I Exam.