2024 LeapUp Edutech PVT. LTD

Business valuation is a process of evaluating a company’s monetary (or better say economic) worth. It’s used in the determination of a company’s sale value, in establishing partner ownership, mergers and acquisitions, strategic planning, equity financing, debt financing, litigation and dispute resolution, etc. This involves assessing assets, and liabilities, forecasting revenue, expenses, cash flows, etc.

Valuation analysts use a range of methods to estimate a business’s value, focusing on its future earnings potential for assessing its worth.

Today, we shall discuss a few of the popular valuation methods in this article. But before that let’s understand why valuation is required and what’s the need to master this craft!

If you’re here, you might have heard of the popular show Shark Tank India, and the significance company valuation holds. Even after having an amazing product, many founders failed to grab a deal because of an incorrect or hyped valuation!

Valuing a business isn’t simply an abstract exercise; instead, it plays a pivotal role in varied business use cases and guides them while making crucial decisions.

Deep dive into the comprehensive analysis of various business valuation methodologies and their pros and cons.

What is DCF?

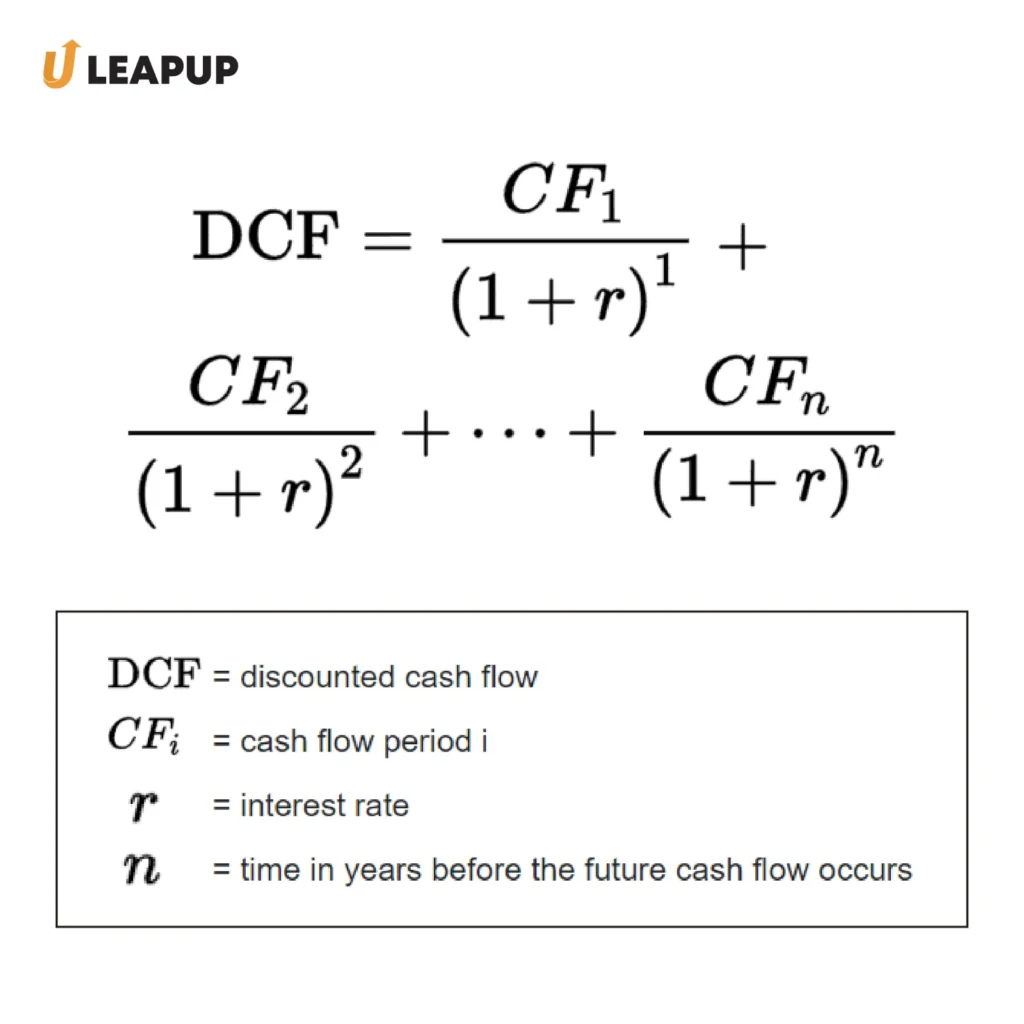

Discounted Cash Flow (DCF) analysis is useful in determining the intrinsic value of an entity by estimating the present value of its expected future cash flows while taking risk into account. It relies on the principle that the value of a business is the sum of all its future cash flows, discounted to their present value.

DCF model stands on three pillars: Cash Flows, Growth, and Risk.

Pros:

Cons:

DCF Utilizes future cash flows adjusted for inflation to determine business value. Free cash flows are emphasized as the key value driver. Relies on projecting discounted FCF using WACC, growth rate, and perpetual growth rate.

Take for instance, suppose a company expects to generate $4 million in free cash flow annually for the next 10 years. Using a discount rate of 12%, the present value of these cash flows would be calculated to arrive at the business valuation

Comparable Company Analysis (CCA) is also known as trading multiples or relative valuation methodology which is used to derive an entity’s value by comparing it to similar publicly traded companies. It involves examining various financial metrics and valuation multiples of comparable companies within the same sector or industry to fetch the target company’s value.

Here, we are going to talk about the two most commonly used multiples availed within the framework of CCA for assessing a company’s value- Revenue Multiple and EBITDA Multiple.

The EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) method of business valuation is quite simple. It is calculated by multiplying current EBITDA by an agreed-upon multiplier, resulting in a quick estimate of the entity’s worth.

Pros:

Cons:

To understand better, say a company has an EBITDA of 20 million and the agreed-upon multiplier is 7, then the valuation as per this method would be 140 million.

The Revenue Model Method of Valuation assesses a business’s worth by applying a multiplier to its total sales. It serves as an alternative to the EBITDA Multiple method, especially when EBITDA is negative or unavailable.

Pros:

Cons:

Let’s understand with an example, say If a company’s annual revenue is $5 million and the industry-standard multiplier is 2, the valuation would be $10 million.

The Precedent Transactions business valuation method derives the worth by analyzing comparable transactions within the industry. It avails multiples such as net income or EBITDA for calculation. This method acts more as a market barometer than a strict approach for estimating valuations.

PE firms often use Precedent transactions in the case of valuing startups by identifying recent transactions similar to the target company in terms of business model, industry, growth stage, and other such factors. These transactions can be investments, mergers, and acquisitions.

Mainly, this methodology proves quite useful when market multiples are not present.

Pros:

Cons:

Asset-based valuation is a method where company valuation is assessed by its net assets or liquidation value. This is mainly suitable for asset-rich yet low-profit-making entities.

For instance, a furniture business determines its value by its furniture inventory, property, and related equipment.

This method of business valuation opts for a bottom-up approach, where a business is valued as a sum of its parts, focusing on assets like inventory, machinery, intellectual property, and goodwill. It fits fine in the asset-rich sectors, such as furniture stores, construction, vehicle rentals, etc.

There are two main approaches to this valuation methodology-

Under this methodology, the company’s operations are assumed to be a going concern.

The value of a company is derived by reducing its liabilities from the fair market value of its assets.

Pros:

Cons:

This method assesses the value of a business as if it were to be liquidated, i.e., if its assets were sold off and liabilities paid off. The liquidation Value approach assumes that an entity is not a going concern and focuses on the immediate sale value of its assets.

Pros:

Cons:

This method sees companies as a compilation of real options. It allows for the valuation of strategic opportunities beyond traditional means.

In Real Option Analysis, Valuation analysts assess the value of a company by considering uncertainties and potential market changes.

Essentially, the Real Option Valuation Method provides a framework for valuing flexibility and strategic choices in an uncertain environment, be it for an entire company or a specific project within that company.

For instance, it can be used by a mineral exploration firm for estimating various exploration projects based on potential outcomes, which can aid in strategic investment decisions amidst uncertain geological conditions. On the other hand, a mature consumer goods industry or low-tech manufacturing business might not opt for it.

Pros:

Cons:

As Professor Ashwath Damodaran says, Valuation isn’t just about numbers, but a craft that requires patience and practice. It is a map that can help business owners make informed decisions and bank into untapped potential.

There are many methods for valuing a company. Selecting the correct valuation method depends on various factors such as industry and the growth potential of a business.

Do you wish to learn this craft? If yes, then check out our comprehensive Financial Modelling and Valuations program.

Even if you are not ready to get your hands in the nitty gritty of valuations, you can still register for the latest webinar

“Career in Finance” which answers every imaginable query in the field. (and yes, it’s free!!!)

Till then, Happy FinUpskilling:)

Student

2024 LeapUp Edutech PVT. LTD