2024 LeapUp Edutech PVT. LTD

CFA- hardly there is anybody in the world of finance who is unaware of this word.

The curriculum is known to teach crucial skills for making financial decisions and investment management. It covers various topics like statistics, economics, quant, and investment management. The diverse range of topics opens a myriad of career options after CFA. Opportunities include, but are not limited to risk management, portfolio management, equity research, valuations, etc.

Today, in this article we will be discussing the popular 5 after CFA Jobs.

So what are you waiting for? Scroll Down!

Feel free to use this image by giving us an attribution link

What is a Portfolio Manager?

Portfolio Management is one of the most favored career options among CFA Charterholders. A portfolio manager is entrusted with investing their clients’ capital. They make these decisions by researching various market conditions ensuring a balanced risk-reward ratio. Portfolio management demands immense responsibility and is an equally rewarding career option after CFA.

Skills Required to be a Portfolio Manager

To become an excellent portfolio manager, an individual needs to be

Apart from the above, a portfolio manager is also required to be competent in evaluating performances.

Duties of a Portfolio Manager

Here comes the most important section of our decoding Portfolio Management as a Career Options after CFA- What are the roles and responsibilities of a Portfolio Manager?

As the name suggests, portfolio managers’ prime duties involve managing client’s portfolios. It includes crafting and executing investment strategies. These strategies are designed to meet client’s goals and make trading decisions on behalf of them.

Portfolio managers can either act as active or passive managers, overseeing everyday funds like mutual funds, closed funds, hedge funds, etc.

Additionally, they also collaborate with financial institutions to mitigate tax burdens and optimize revenues. Eventually, everything is done with the target for achieving their client’s financial goals.

Average Salary

Now comes the most awaited section, the one, which our readers wanted to directly hop in!

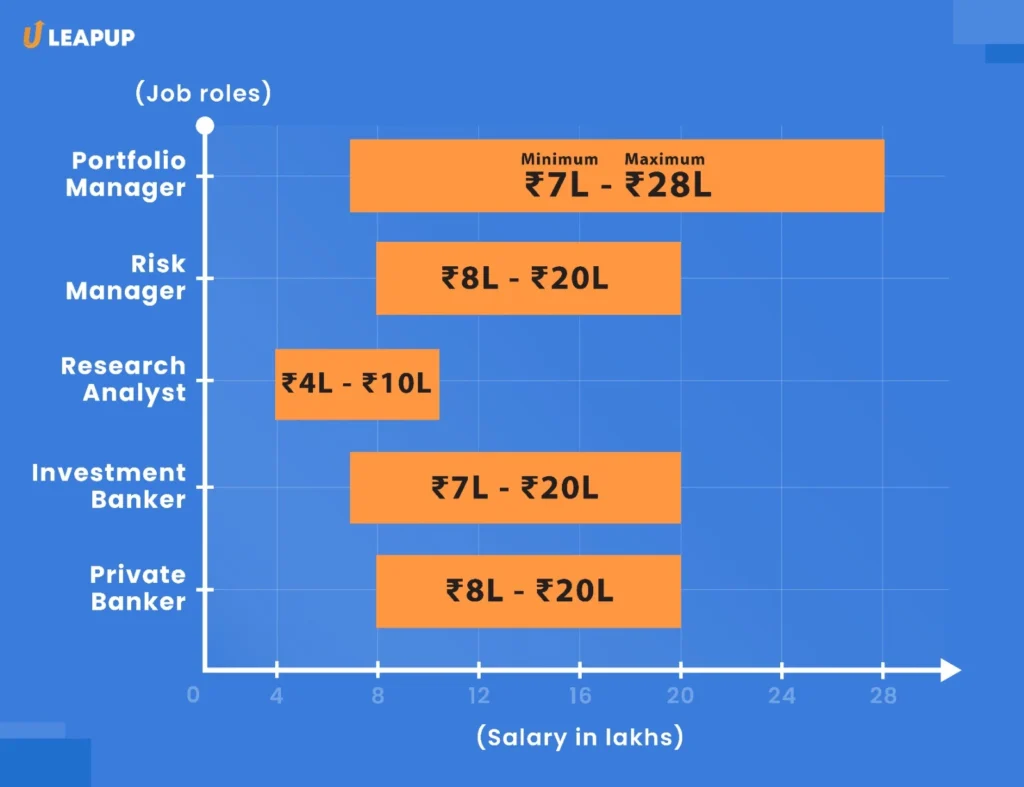

The average salary of a portfolio manager stands at INR 7-28 LPA in India, reflecting the high level of responsibility and expertise associated with the role.

To sum it up, portfolio managers play an essential role in making investment decisions and crafting and executing strategies to meet optimal returns on clients’ investments.

What is a Risk Manager?

The next in the series is Risk Management.

Risk Management is a process of identifying, analyzing, and actions required to mitigate risks to avoid uncertainty in financial decisions. The CFA curriculum trains candidates to be risk managers, look for details, and connect the dots for effective risk management.

There are various types of risks such as natural risks, financial risks, and operational risks; risk managers are trained to implement precautionary measures to reduce the negative effects caused by these risks.

What are the Skills Required to be a Risk Manager?

To excel as a risk manager one needs a combination of the following-

What are the Duties of a Risk Manager?

The duties of a risk manager include analyzing and controlling risk-related elements in an organization. They gather risk data and manage liability programs to determine potential losses. Additionally, the responsibilities also include responding to inquiries, researching, and resolving queries related to the risk processes.

Risk managers interpret data using RIMS (Risk Information Management Software) to evaluate future risks, and practices that contribute to it, compile reports, and evaluate techniques for mitigating the same.

What is the Average Salary of a Risk Manager?

The average income for a risk manager is INR 8-20 LPA in India.

What is a Research Analyst?

Research analysts, Equity Analysts, financial analysts, securities analysts-call it what you want. Every role is just a little tweak of others. A research analyst analyzes financial records to provide insights to clients. The CFA Programme equips candidates with the required skill set to be proficient in the same.

Skills Required to be a Research Analyst:

CFA Charter holders often work as equity research analysts or credit analysts. In this section, we are mainly going to cover the former, i.e. equity research analysts.

To be a good research analyst one needs to –

Duties of a Research Analyst:

An equity research analyst does industry and company fundamental research for seeking investment opportunities. With the help of their in-depth financial research, they shell out detailed equity research reports that give buy or sell options on a stock. The CFA program is equipped to impart financial analysis and investment management skills and prepare one to take research analysis as a career option after CFA.

Average Research Analyst Income

Research analysts earn an average of INR 4-10 LPA in India.

Before, proceeding further do you also wish to take the CFA Charter to embark on a career in Core Finance? Register for our Free CFA Decoded Webinar that answers your every possible query!

What is an Investment Banker?

An investment banker analyzes and considers investment possibilities, particularly in Mergers and Acquisitions and equity investments. The CFA program includes sections on corporate investments, fixed incomes, and economics, preparing candidates for this role.

Skills Required to be an Investment Banker

These are the skills that one needs to master to kickstart their career as an investment banker-

Duties of an Investment Banker

Investment bankers help clients raise capital, perform valuation methods, provide recommendations for various transactions, develop client relationships, review financing materials, and perform due diligence. They play a crucial role in the growth of organizations.

Investment bankers engage in various activities such as raising capital through methods like Book Building and IPOs, drafting prospectuses, conducting investment meetings, and advising on mergers, acquisitions, and organizational restructuring. The CFA program’s comprehensive knowledge of financial markets is invaluable for aspiring investment bankers.

Average Salary of an Investment Banker

The average income for investment bankers is INR 7-20 LPA in India.

What is a Private Banker?

Private banking involves offering banking, investment, tax management, and other financial services tailored to high-net-worth individuals or private clients. Unlike traditional retail banking, private banking emphasizes personalized financial services for its affluent clientele.

Skills Required to be a Private Banker

To excel as a private banker, one needs to have the following-

Duties of a Private Banker

Private bankers manage the accounts of high-net-worth clients, providing personalized financial services. They allocate their best-performing employees to ensure optimal investment returns for clients. Duties include analyzing clients’ financial situations, creating customized financial plans, and implementing strategies to meet clients’ financial goals.

Average Income of a Private Banker

The average income for a private banker is ₹8L – ₹21L/yr in India.

Feel free to use this image by giving us an attribution link

Are you interested in investment banking, research analysis, or portfolio management as your career option after CFA?

The CFA credential represents excellence and proficiency in the field. Pursuing this globally accepted certification demonstrates your commitment to mastering financial expertise and continuous learning.

Wondering where to start?

Register in the FREE CFA Decoded Webinar by Leapup that covers everything related to CFA.

Also, you can invest in Finelite Solutions which empowers finance professionals with essential skills to thrive. The USP of this product is to help you build your Finance Career instead of just helping you clear exams.

Need more such insightful content, directly delivered to your mailbox?

Then shoot your address right below ⬇️

Till then, Happy Learning 🙂

2024 LeapUp Edutech PVT. LTD