2024 LeapUp Edutech PVT. LTD

Have you seen Hrithik Roshan in Zindagi Na Milegi Dubara, a finesse professional in a constant run, on unending calls with high-profile clients to provide some finance services?

He was portraying the lifestyle of an Investment Banker!

And today our article is all about getting that ever-busy, high-paying job. So are you ready for the ride? But before we delve into the answer to “How to become an Investment Banker?”

Let’s first answer the question- “What is an Investment Banking Job?”

An investment banker is a highly skilled finance professional who plays a crucial role between businesses and investors.

An investment bank, the work station of Banker, offers a wide variety of financial services that include issuing securities, obtaining loans, investment management, and mergers facilitation.

These bankers have expertise in providing financial consultation, setting security prices, and guiding institutions toward financial growth.

An investment banker collaborates closely with top management to steer the company’s financial growth.

The Investment Banking Job Role comprises the following duties-

If you’re someone who has a fine blend of an analytical mindset and the ability to articulate thoughts convincingly with a grasp on finance and accountancy, then the suit of an Investment Banker might fit you fine.

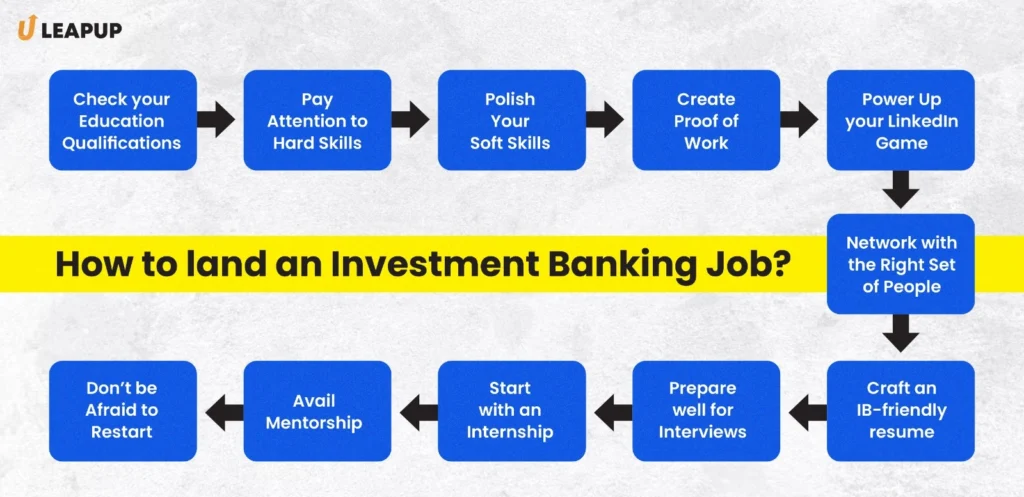

This article serves as a 10-step guide discussing the educational prerequisites, skills, experience, and other such relevant details to grab a job in this field and answer your query- How to get Investment Banking Job?

Do you know Financial Modelling & Valuations are some of the most essential skills required to make a career in Investment Banking?

CFA – The first and foremost course that tops the list is the Chartered Financial Analyst (CFA) certification. This program offers intensive training in investment and finance, covering subjects like economics, corporate finance, derivatives, and more. Plus, you can start while you’re in the last year of your bachelor’s degree, with the course lasting anywhere from one to four years.

As a CFA Charter holding comprehensive knowledge in economics, corporate finance, and other crucial areas, you’ll be well-prepared for success in Investment Banking.

CA – The second preferred educational qualification in the list is Chartered Accountancy.

Many freshly qualified CAs are increasingly drawn to this field for its handsome package and popularity. Many students find themselves excelling in roles like Financial Due Diligence because of the detailed curriculum they have spent hours learning in their journey to becoming CA.

So, if you are already a chartered accountant or are in the process of becoming one, then you have the basic building required to thrive in this career.

MBA – A 2-year degree in MBA Finance is one of the most coveted qualifications for those who wish to enter this arena. This credential, from a reputed B-school like IIM, ISB, Xavier’s, IIFT, etc can directly open the doors in finance, banking, and insurance sectors.

However, we have seen many students who don’t hail from top institutions in the country and yet make a dent in this industry under the right mentorship, sheer hard work, and a pinch of luck. The two-year program equips one with finance, marketing, accounting, strategy Ops, Financial analysis, and management consulting- everything that plays a pivotal role in the IB domain.

Graduation – Yes, Graduation can also lead you to the finest brokerage firms, and investment banks and it is the minimum one can have. However, this will usually fetch you an entry-level position, such as an intern.

While one can hope to hop into Investment Banking from College Corridors, we advise you to build relevant skills and experience through a practical Investment Banking Program to thrive in this field.

Students nearing graduation should gather hands-on experience at brokerage houses and Investment banks.

Sharpen your Analytical Skills – As we mentioned earlier, one of the primary prerequisites to get into Investment Banking is a strong analytical mindset. The job profile relied heavily on analytical skills be it data analysis, industry research, or financial modeling. A brain that can break down a complex module into simpler fragments is the hallmark of being a successful investment banker.

Do you know basic Accounting & Finance? A Core Finance Job without Finance knowledge is like cooking without spices.

Recruiters will not consider at any cost who lack fundamentals like Balance Sheet, Ratio Analysis, Profit Loss, Cash Flow, etc. Strengthening fundamentals and staying abreast with industry trends is an important ingredient in the success recipe.

Learn Financial Modelling & Valuations – The ability to construct financial models from scratch and run valuations on them is yet another skill that recruiters highly appreciate in aspiring investment bankers.

Bankers rely heavily on these models for their daily work and actively seek individuals who have their skin in the game.

MS Office- Excel & Powerpoint – Proficiency in MS Office, especially Excel and PowerPoint is essential for this career. Most of the work involves playing around with these apps from drafting Pitch documents to presentations and analyzing large data sets.

Apart from the MS Office tools, learning SQL and Tableau can prove to be a cherry on the cake for data visualization and analysis.

Feel free to use this image, give us attribution Link

Developing strong soft skills like the ones below is essential to raising the ladder in this field.

Communication – You’ll regularly interact with diverse clients and stakeholders, which requires clear communication for effectively conveying complex financial concepts. This fosters trust and enhances decision-making processes.

Effective communication is essential for negotiating deals and finalizing transactions.

Research – In my opinion, research should be a synonym for investment banking. Stay updated with market trends, learn to evaluate businesses, and identify potential investment opportunities. Research varied sectors, industries, and companies to be in investment banking.

Attention to detail – is paramount in the high-pressure environment of investment banking. Even minor errors can have significant consequences, making precision essential to meet performance standards.

What is a better way to communicate your skill set than a proof of work? Build Financial Models, do valuations, run sensitivity analysis- and document your work in Google Sheets or some other format. Showcase it in front of the right audience. Remember, a basic cook who is ready to serve a food platter is much more appreciated than a polished chef who has never been into the kitchen!

Leverage networking for improved visibility and better future chances at getting a callback from a recruiter.

Target Your Networking Efforts – Investment bankers thrive on connections. Begin by identifying individuals who hold the keys to hiring or can introduce you to decision-makers. Family ties, mentorships, or acquaintances within the industry can significantly bolster your chances.

Leverage School Resources – If you’re fortunate to attend a target school directly recruited by investment banks, tap into your career center’s resources. Seek introductions to alumni employed in investment banking, as they can offer invaluable insights and potentially open doors for you.

PowerUp your LinkedIn Game – As discussed previously, LinkedIn is a goldmine for networking opportunities. Craft a professional and engaging profile. Update the Bio, and share your story. Reach out to connections who have ties to the investment banking sector. Share your projects, and proof of work with the right audience. Craft your messages tactfully, focusing on learning about the industry rather than outright job requests. Genuine curiosity can spark meaningful connections.

Join Professional Organizations – Become an active member of your local CFA® society. Engage with professionals who have insights into the investment banking realm. These connections may serve as bridges to investment bankers, providing you with opportunities to expand your network and gain valuable advice.

Participate in NIBC – Distinguish yourself by participating in events like the NIBC Global Investment Banking Competition. These platforms not only showcase your skills but also offer opportunities to network with industry professionals from across the globe.

Craft a stellar resume by highlighting relevant experience, education, skills, and certification. Tailor your resume to the Job Description. Even though the basic requirements are the same, every company posts different descriptions as per their needs. Hence, it is important to customize your resume accordingly. Highlight your achievements, and showcase your proof of work. Also, make sure to edit and format properly as per industry standards. Remember, grammatical errors are a big no-no!

The interview process goes from initial screening to multiple rounds, to the final decision process. Here are some tips on how to prepare for an IB interview:

Type of Expected Interview Questions:

Problem-Solving:

Technical:

Behavioral:

Sample Questions:

Mock Interviews:

Prepare diligently for each stage of the interview. Hone your responses, craft an IB-friendly resume, and draft a cover letter if required. By doing all of these steps up and above, you shall increase your chances of securing a position in Investment Banking.

Internships pave the way for recent graduates to secure full-time employment. They provide hands-on experience, exposure to the industry culture, and a chance to impress employers. However, competition for internships at investment banks is fierce. Hence, one needs to go the extra mile to grab one.

Nobody can replace the place of a mentor. Numerous institutes in India offer mentorship programs to guide candidates through the intricacies of investment banking, from foundational learning to securing prestigious roles in the industry. LeapUp is one such institute, offering specialized courses tailored for aspiring professionals entering the investment banking sector.

LeapUp provides an array of courses designed to equip budding students with the essential skills and knowledge required for success in the investment banking field. Their Financial Modelling and Valuation Course imparts fundamental concepts and practical skills crucial for roles in equity research, investment banking, portfolio management, and financial planning. Additionally, LeapUp offers a comprehensive CFA Course, providing in-depth preparation for the Chartered Financial Analyst (CFA) curriculum.

If you failed to get the job of an investment banker in one go, don’t be afraid to restart! Remember, the movie 12th fail !! The investment banking hiring process follows a clear formula. Focus on meeting all the requirements: concise resume, strong GPA, relevant experience, and adeptness in technical and behavioral questions. Use this structured guide for preparation and put in the necessary effort, your door shall open.

Don’t forget- Landing a job is just one step; advancing in your career requires dedication.

2024 LeapUp Edutech PVT. LTD