2025 LeapUp Edutech PVT. LTD

CFA, or Chartered Financial Analyst, the designation is immensely popular within the finance industry, globally. The program is split into three levels. Level 1 serves as the foundational stage, providing the essential groundwork for subsequent levels of the certification.

Renowned for setting a high standard in the finance domain, CFA is highly recommended for anyone who wishes to rise higher in the arena.

With over 170,000 members spread across 165 countries, the program’s global reach showcases its significance.

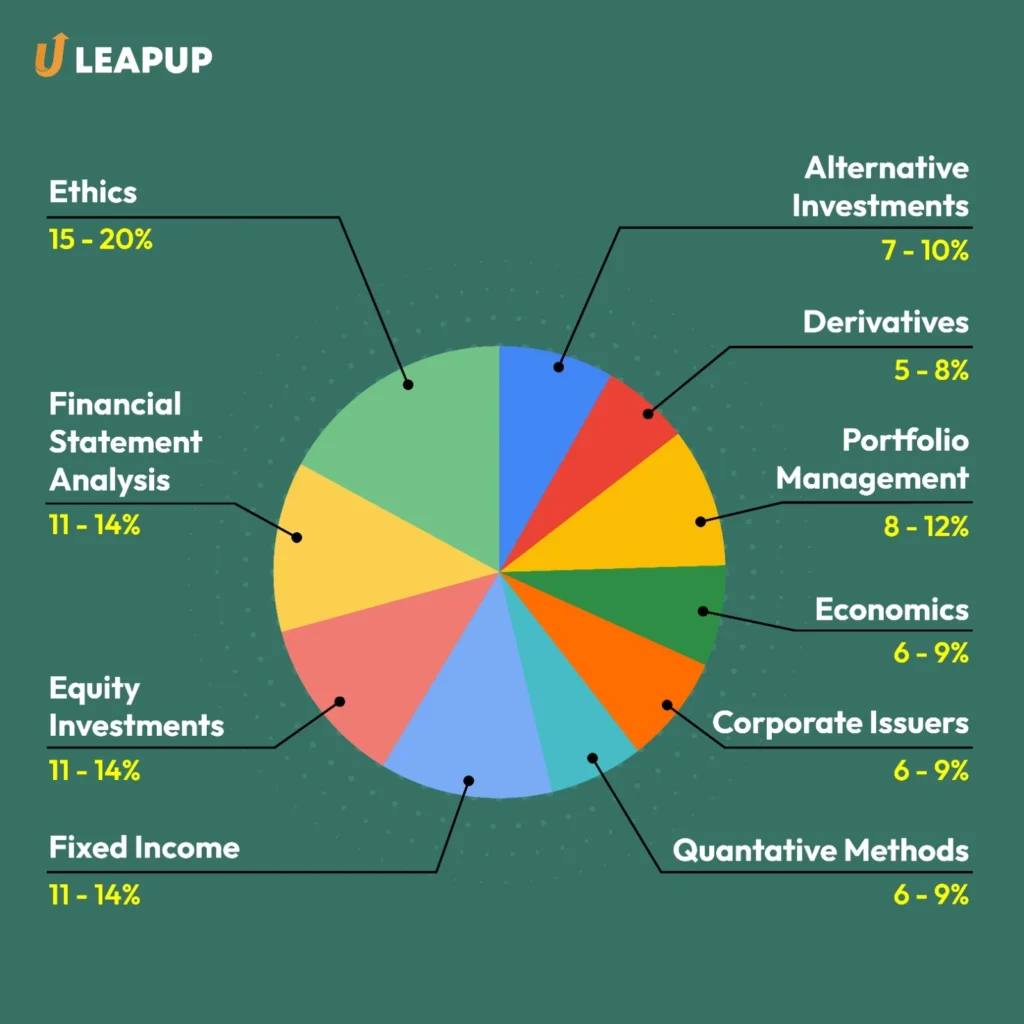

CFA Level 1 curriculum delves into finance and investments extensively, and is tailored for both buy-side and sell-side markets.

In this article, we will discuss the CFA Level 1 Curriculum, dissecting every subject with their share percentage and offering a brief overview of what they entail.

Additionally, we also talk about the CFA Level 1 Exam Fee structure both in INR and dollars. Lastly, the article is summed up with a popular Frequently Asked Questions and a goodie!!!

Intrigued? Keep reading to unravel what is this goodie about…

Dive into the ethical practices and professional standards crucial for navigating the complexities of the finance industry with integrity and responsibility.

This subject covers-

Explore the intricacies of financial reporting, from analyzing income statements to understanding the mechanics of building comprehensive financial models.

The second subject in the line entails the following-

Gain insights into market efficiency, valuation techniques, and portfolio management strategies essential for navigating the dynamic landscape of equity markets.

Equity investment imparts knowledge on the following-

Delve into the world of fixed-income securities, exploring valuation methodologies, yield spreads, and risk analysis to make informed investment decisions.

With Fixed Income analysis, you shall learn to be proficient with the following chapters-

Master quantitative concepts such as discounted cash flow, statistical analysis, and regression techniques, empowering you to analyze financial data with precision and accuracy.

Quant talks about the below-mentioned items, but before you go through the list check our recent article if you’re someone who is also a little afraid of numbers!

Understand the fundamentals of corporate governance, capital budgeting, and financing decisions, vital for evaluating investment opportunities and maximizing shareholder value.

CFA Level 1 Subject corporate finance covers-

Explore the principles of micro and macroeconomics, examining market structures, monetary policies, and their impact on global economic landscapes.

Here the following topics are touched upon-

Learn the essentials of portfolio construction, risk management, and incorporating environmental, social, and governance (ESG) factors into investment strategies.

This subject teaches students about-

Navigate the complexities of derivative markets, from understanding option valuation to utilizing derivatives for effective portfolio hedging and risk management.

The second last in line entails the following-

Explore the diverse world of alternative assets, including hedge funds, real estate, and commodities, to diversify investment portfolios and mitigate risk.

Lastly, with alternate investments, you shall learn about-

Overwhelmed with the syllabus content?

Don’t worry Finelite offers a flexible study program that combines top-notch CFA Coaching with practical skills training, by keeping students’ convenience a priority!

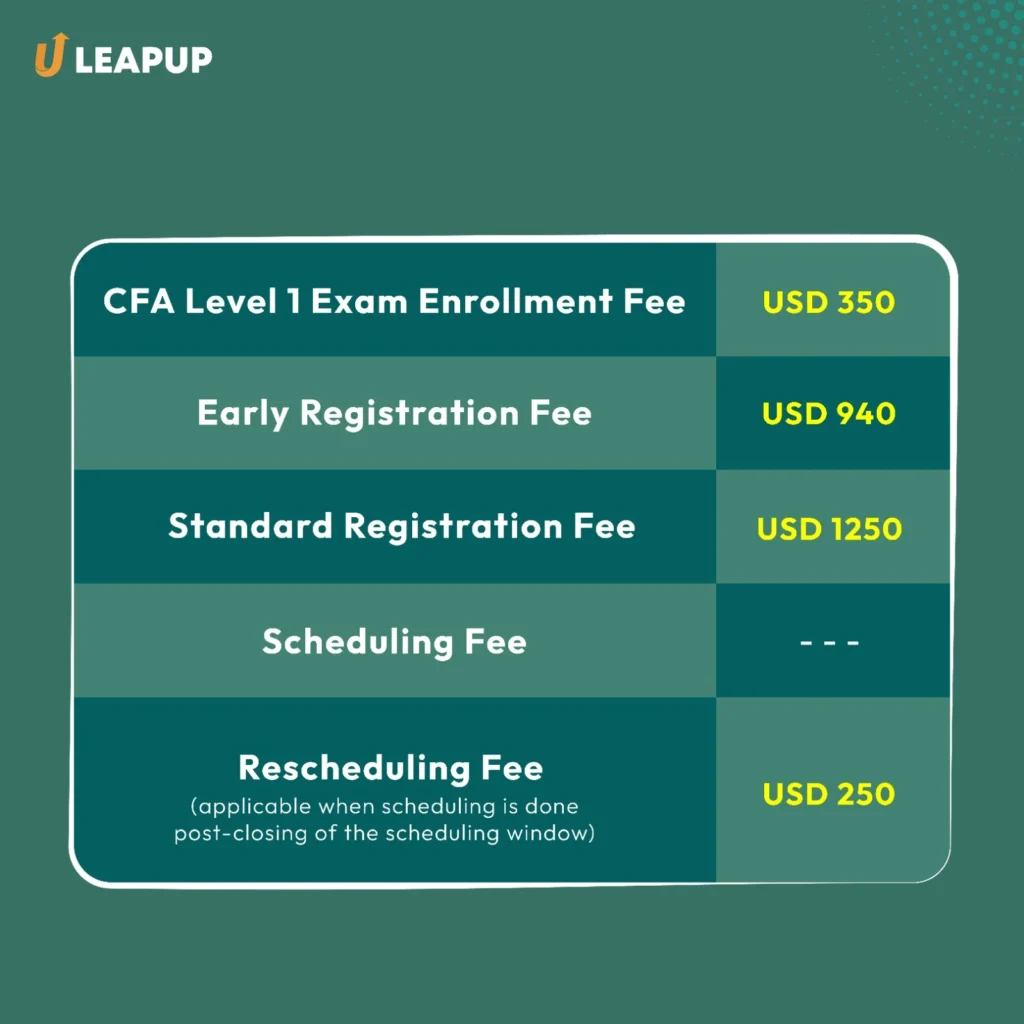

Till now we have got a detailed overview of CFA Level 1 subjects, and the next question that might come up in aspirants’ minds is- how much it’s going to cost?

Before you start googling and piling on more tasks for the Crawler, here is the CFA Level 1 Exam Fee Structure-

Congratulations!

You’ve made it to the end of this guide to understanding the CFA Level 1 curriculum- a crucial step in the CFA Journey. Now you have a clear roadmap on how to navigate through the curriculum with ease.

Being a finance student myself, I can vouch for the significance these subjects hold.

Every module strengthens the backbone of financial analysis and decision-making, lessening the complexities of markets.

Remember, mastering these subjects not only prepares you for the CFA Level 1 exam but also equips you with invaluable knowledge essential for a successful career in finance.

And now comes the best part- the goodie we promised- Free CFA Decoded Webinar which answers all queries related to the subject. Imagine all your doubts solved in one place by our expert mentor who has years of experience in training young minds like yours!

Lastly, don’t forget to check the FAQ section for more insights.

Keep exploring, keep learning, and soon you’ll be well-prepared to conquer the challenges of the CFA Level 1 examination. Happy studying!

To sit for the CFA Level 1, one needs to satisfy at least one out of three following requirements-

1. Holds Bachelor’s degree or equivalent program.

OR

2. Undergrad students with 2 years remaining in their degree completion can sit for CFA Level 1, however, one needs to finish the degree program before taking CFA Level 2.

OR

3. One must have about 4000 hours of experience or higher education acquired over 3 years before registering for the Phase 1 Exam. Ensure that work experience and education timelines don’t overlap.

The course typically takes 2 to 3 years to complete

There are three levels in the CFA exam.

Level I is offered four times a year in February, May, August, and November.

Level II is offered three times a year in May, August, and November.

Level III is offered twice a year in February and August

The Level 1 exam is in a multiple-choice questions (MCQ) Format.

Exam results are typically available within 60 days of taking the exam.

Each session of the exam lasts for 2 hours and 15 minutes.

Only multiple-choice questions are included in the CFA Level 1 exam.

2025 LeapUp Edutech PVT. LTD

The only CFA Training Program that provides complete personalization via 1-on-1 Mentorship & Instant Doubt Solving by qualified faculties.

This program is specially curated for Working Professionals & Students with busy schedules.

Join our Level 2 Online Training and Leapup In Your Core Finance Career.

Appear for 8 CFA mock test level 1 in Computer-Based Testing (CBT) format + solve 30 subjectwise CFA level one practice questions.

Appear for 8 mocks in CBT format to crack your CFA Level I Exam.