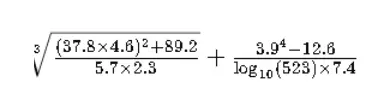

Can you solve this equation without using a scientific calculator?

Unless you are Shakuntala Devi or some other mathematical genius, it is a bit difficult to do it without using any tool! Similarly for projecting a company’s financial future via fundamental analysis, one needs a grasp on Financial Models.

This article demystifies the step-by-step guide to building financial models.

But first thing first, let’s understand what a financial model is.

Financial models are the toolkit that aids in forecasting a company’s future.

By inputting past and present data into these models, we get a window to the future performance of the company which proves helpful in decision-making. Financial models are based on accounting principles, so a grasp of them is a must.

They act as financial machines, and learning to operate them is a must for anyone who wants to project revenues, cash flows, and other important indicators.

While creating accurate models can be challenging, the benefits are immense—which is what we are going to cover in the next section.

Financial modeling is a vital skill for anyone seeking a career in finance, and this step-by-step guide will help you understand how to create a financial model.

Here is a step-by-step guide to building a financial model-

When you build a financial model, first decide why you’re doing it. This helps you to understand what data you require, what assumptions you are supposed to take-

Okay so there are two steps to be followed to answer the above-mentioned question-

First, what are you expecting to achieve from building the model? Do you wish to project expenses? Or do you want to forecast sales instead? What exactly is your purpose?

Second, Look at the existing models and adjust them as per your requirements. But first figure out why, or else the outcome would be far from appropriate predictions.

There are mainly two approaches to follow here-

Top Down:

Bottom Up:

So, which one is right for you?

Once you’re done with the above two steps, i.e. what is the purpose and approach for your financial model going to be, next get your hands on gathering data from financial statements, surveys, and market research.

Say if the purpose of your model is to forecast an entity’s revenue, then you require its historical FS, economy indicators, market trends, and industry reports.

Once the data collection process is over, input them into the model and start building formulas.

The next step in line is to understand the inputs that go into the model and the outputs expected from it. Assumptions and inputs like sales growth, capital expenditure, and interest rates are the inputs of the financial model, while profitability, cash flow, and return on investment go into the output section.

Feel free to use this image by giving us an attribution link

Financial modeling software varies in complexity and features. There are many options available, so you can pick one that suits your needs.

For beginners, a simple and widely used option like Microsoft Excel is a good choice. It doesn’t require much technical knowledge and is widely used in the industry.

If you need more advanced features, apps like Crystal Reports or Tableau offer greater functionality, but they are a little complex to adapt.

A financial model consists of two main parts:

Assumptions (input) and Financial Statements (output), including the income statement, balance sheet, and cash flow statement. Additional elements like capital allocation, valuation, and sensitivity analysis can also be included based on the company’s needs. Let’s break down each part:

Assumptions and Drivers:

The Income Statement:

The Balance Sheet:

The Cash Flow Statement:

After completing the three financial statements, it’s time to delve into valuation and sensitivity analysis to refine your financial model.

Discounted Cash Flow Analysis

With the groundwork laid by the financial statements, we initiate a discounted cash flow analysis. This involves estimating the free cash flow and then discounting it to present value using either the opportunity cost or the required rate of return. This initial step provides an initial valuation of the company.

There are other methods of valuation, which we can avail to perform this step, such as Market value, asset-based, etc.

Learn more about different types of business valuation methodologies here.

Assess Risk with Sensitivity Analysis

Sensitivity analysis becomes crucial at this stage. By adjusting assumptions and exploring different operating scenarios, we can gauge how changes affect the company’s valuation.

But first, understand the concept of sensitivity analysis-

What is Sensitivity Analysis?

Sensitivity analysis is a fundamental technique within financial modeling, aimed at evaluating the impact of altering assumptions on a company’s financial performance. It allows for the identification of critical assumptions and their potential influence on financial outcomes.

Test the model’s sensitivity to changes in assumptions, such as varying interest rates or growth rates, to observe their impact on results.

This exercise helps in understanding and planning for potential risks, such as fluctuations in sales or unexpected shifts in marketing conversions.

Check for Errors: Ensure model accuracy by thoroughly examining for mistakes or formula discrepancies, commonly overlooked errors in financial modeling.

Simplify Your Model: Enhance usability by simplifying complex models. A simplified structure aids in comprehension and usability, facilitating effective decision-making processes.

Before finalizing your financial model, it’s beneficial to seek feedback from others. Feedback can help identify errors and areas for improvement. As a financial analyst, sharing your model with colleagues, clients, or supervisors is common practice, emphasizing the importance of clarity and usability. You can also leverage LinkedIn to gather feedback on your model by connecting with relevant parties.

A well-constructed financial model exhibits specific features that enhance its effectiveness-

Adheres to precision and reliability in the calculation.

Feel free to use this image by giving us an attribution link

As much it is required to build a good financial model, it is equally important to communicate it with the relevant parties with effective model communication techniques, a few of which are listed below:

Provide clear instructions for utilizing the model, ensuring ease of use for stakeholders.

Conclusively, building a financial model isn’t scary if you walk one step at a time. However, it is essential to plan strategically and know why you want to build a model. This can save you from having to make big changes later on. While using templates can be helpful to start with, it’s better to create your model from scratch to understand your business’s needs. This shows that you know your business well and can impress potential investors, which could help you get funding.

Enroll in the Best Financial Modeling and Valuation course-

Do you run a business, an investor, or a finance enthusiast willing to learn valuations but is scared to start? Enroll in our Comprehensive Financial Modelling and Valuations Course that covers all nitty gritties. It’s designed to help you feel confident in analyzing finances and making smart decisions.

Don’t believe us? See what our students have to say-

The only CFA Training Program that provides complete personalization via 1-on-1 Mentorship & Instant Doubt Solving by qualified faculties.

This program is specially curated for Working Professionals & Students with busy schedules.

Join our Level 2 Online Training and Leapup In Your Core Finance Career.

Appear for 8 CFA mock test level 1 in Computer-Based Testing (CBT) format + solve 30 subjectwise CFA level one practice questions.

Appear for 8 mocks in CBT format to crack your CFA Level I Exam.