“Can I be a Charter Holder without much grasp on maths, or say even finance?”– open a CFA Prep Quora or Reddit Group- and every next question would be in line with this one!

Surrounded by people who already know what a standard deviation is, ones that have structured study plans on “how to crack CFA in so & so months”- we know how overwhelmed you must be!

But don’t worry, as a wise person once said, when there is a will, there is a way. And today Leapup has brought you this article to settle all your queries and calm your chaos.

Accept that you don’t know and it’s okay!

The first and foremost step in any crucial journey is acceptance. Accept that you know a little less than those freshly passed-out Finance Grads, who have learned to navigate their way through Finance and Numbers. However, this isn’t difficult to overcome, you just need to push more than your peers, and you can get it done. If the CFA Charter is your goal, then some extra learning can’t demotivate it, can it?

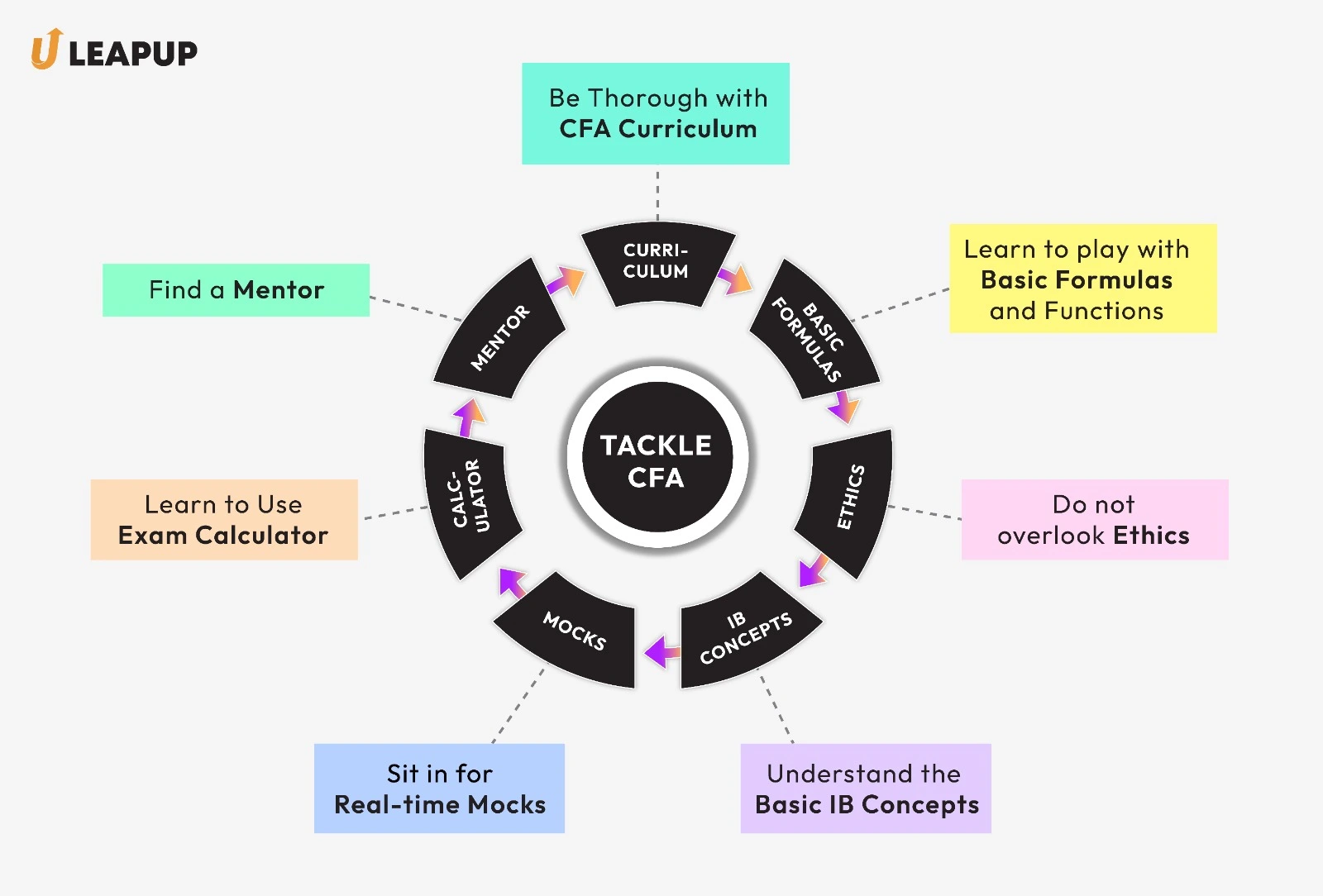

This step isn’t just about filling the gap between equations and their explanations. Instead, it’s about understanding the curriculum, the background, and the contexts of subjects- why they are included, and what’s their purpose. It gets easier to dive into the subjects when you know the “why” behind them. While you know maths conceptually, this step will make you understand the more practical usage of the same.

Many students struggle with maths- So roll your sleeves and learn the basics, at least!

Yes, that’s true! A significant number of CFA-pursuing students struggle with numbers. And this is not only applicable to people who graduated a while ago but also to the ones who are attending classes.

The mathematics used here isn’t as complicated as it might appear from the outside. Someone who knows how to play around formulae and solve some fractions can navigate through the curriculum. Having said that, an analytical mind is still better than a non-analytical one as every minute counts on CFA Exam day.

The next step is to do a little research and understand the difference between the 3 levels of CFA. Knowing your weak and strong areas, you can approach the levels with that kinda preparation. Your strategy can vary as per your contextual knowledge, especially at the different levels of CFA.

CFA Level 1 and CFA Level 2 have separate sections named, quantitative methods which cover mathematical concepts like DCF, Net Present Value, and a slew of statistical topics like hypothesis testing and probability distributions. Even though quant just makes up 5-10% of the course, calculations are required in nearly all subjects.

However, the 3rd level is focused on the qualitative aspect of investment management. But that doesn’t imply you can skip numbers altogether. They will come in handy when you have to do some essay writing on comparing approaches to investment or evaluating rates of return

Elevate your preparation with our Flexi-Prep Buddy solution comprising recorded CFA Level 1 Lectures of all 10 subjects, weekly doubt sessions, and practice in a real-time format.

Answering the title question- “Can you do CFA without Maths?” – You can’t skid through the levels of CFA without stretching your Math Muscles. If you master numbers, you shall be able to do 50% of calculations in your head and speed up your CFA Exam Solving time. However for the rest 50% you need a CFA Exam Calculator. And the next pointer in the list is about the same-

When we talk about basic calculations, there is no speed solver than your brain itself!

But the calculations that demand a little extra, a CFA Exam Calculator can prove to be the best tool.

Go down to basics, and learn the functions of the Calculator. Then slowly move toward complicated formulae and functions to advance your CFA Exam preparation.

Practice it until it becomes part of your muscle memory.

Think about it- an investment banker, who doesn’t speak the language of the investment industry! It’s like a magician who doesn’t know any tricks to showcase at a magic show.

Learn the textbook terminologies to the jargon used on the trading desk- take time to comprehend through concepts.

Wondering where you can start? Leapup has launched the IB Simplified Series, which unboxes one Investment Banking Terminology at a time. Tap on the link and Thank me Later!

This is a no-brainer. We get it that you’re afraid of numbers. But practicing Quant subjects giving vibes of the CFA Exam in real-time will help raise your confidence bars.

And why just limit it to quant subjects, instead get an Ultimate Practice CFA Mock Series that assesses your preparation in real-time and improves your chances of clearing the CFA Exam.

We understand your discomfort with numbers and other such hardcore sections of the exam.

But that doesn’t mean your Ethics don’t count for your efforts. You might consider this to be the easiest subject as it relies on reading comprehension, especially if you have a grasp on reasoning and comprehension. Having said that, this is part of the CFA Curriculum, which accounts for certain standards. Neglecting this overall can seriously damage the scorecard. Imagine this- the lowest-hanging fruit is missed by sheer fear of missing out on the furthest apples!

You don’t want that, right? Hence, do spend some time and effort in Ethics as well.

There are going to be times in your CFA Exam Preparations Journey when you might start wondering if all this effort is worth it or not. Hefty curriculum, “n” number of subjects, too much competition, doubts, anxiety, exam stress- we understand how overwhelming it gets.

The solution to all this is to find the right mentor– someone who has first-hand years of experience in guiding your way through.

Student

The only CFA Training Program that provides complete personalization via 1-on-1 Mentorship & Instant Doubt Solving by qualified faculties.

This program is specially curated for Working Professionals & Students with busy schedules.

Join our Level 2 Online Training and Leapup In Your Core Finance Career.

Appear for 8 CFA mock test level 1 in Computer-Based Testing (CBT) format + solve 30 subjectwise CFA level one practice questions.

Appear for 8 mocks in CBT format to crack your CFA Level I Exam.