Unlocking the CFA Level 1 Course Outline: A Comprehensive Guide

CFA, or Chartered Financial Analyst, the designation is immensely popular within the finance industry, globally. The program is split into three levels. Level 1 serves as the foundational stage, providing the essential groundwork for subsequent levels of the certification.

Renowned for setting a high standard in the finance domain, CFA is highly recommended for anyone who wishes to rise higher in the arena.

With over 170,000 members spread across 165 countries, the program’s global reach showcases its significance.

CFA Level 1 curriculum delves into finance and investments extensively, and is tailored for both buy-side and sell-side markets.

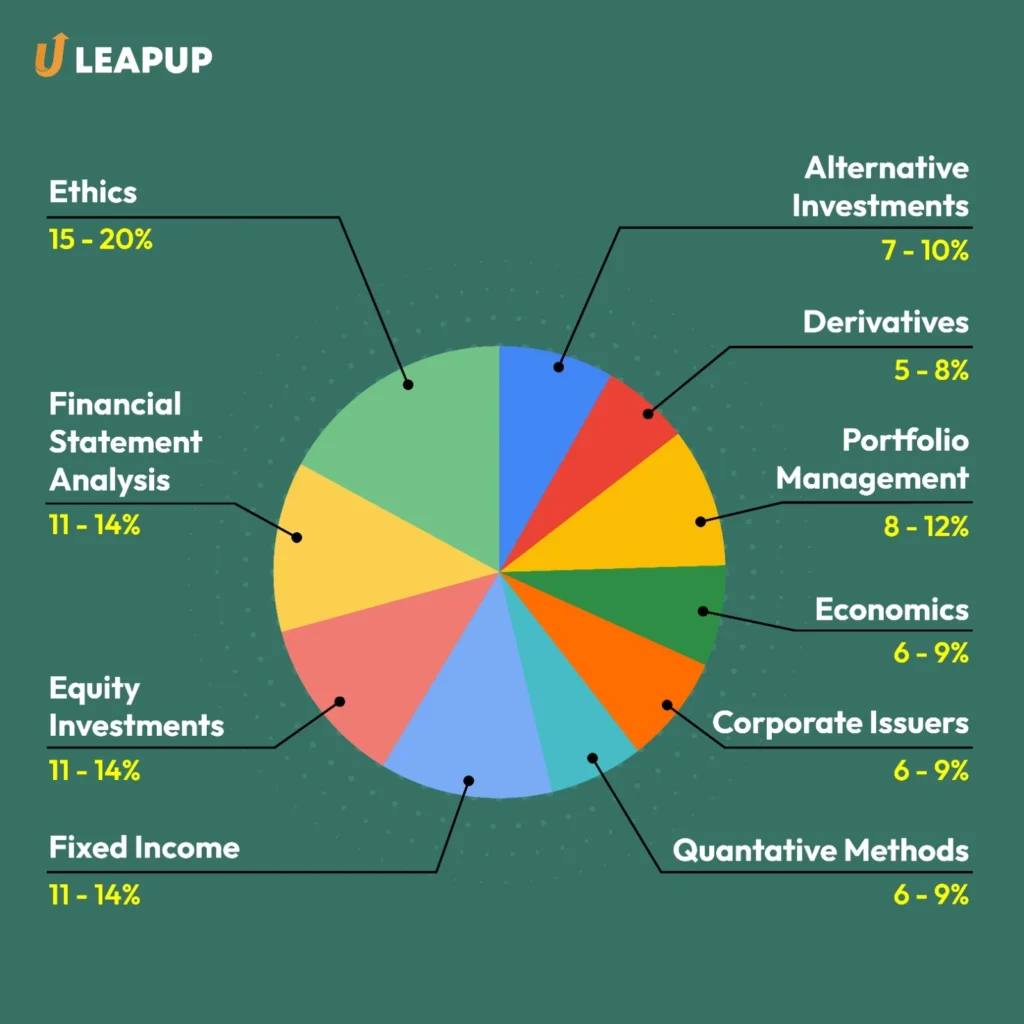

In this article, we will discuss the CFA Level 1 Curriculum, dissecting every subject with their share percentage and offering a brief overview of what they entail.

Additionally, we also talk about the CFA Level 1 Exam Fee structure both in INR and dollars. Lastly, the article is summed up with a popular Frequently Asked Questions and a goodie!!!

Intrigued? Keep reading to unravel what is this goodie about…

Overview of CFA Level One Course Subjects:

1. Ethics (15-20%)

Dive into the ethical practices and professional standards crucial for navigating the complexities of the finance industry with integrity and responsibility.

This subject covers-

- Ethics and Trust in the Investment Profession

- Code of Ethics and Standards of Professional Conduct

- Guidance for Standards I-VII

- Introduction to the Global Investment Performance Standards (GIPS)

- Ethics Application

2. Financial Statement Analysis (11-14%)

Explore the intricacies of financial reporting, from analyzing income statements to understanding the mechanics of building comprehensive financial models.

The second subject in the line entails the following-

- Analyzing Income Statements

- Analyzing Balance Sheets

- Analyzing Statements of Cash Flow 1

- Analyzing Statements of Cash Flow 2

- Analysis of Inventories

- Analysis of Long-Term Assets

- Topics in Long-Term Liabilities and Equity

- Analysis of Income Taxes

- Financial Reporting Quality

- Financial Analysis Techniques

- Introduction to Financial Statement Modeling

CFA Level 1 Curriculum 2024

3. Equity Investment (11-14%)

Gain insights into market efficiency, valuation techniques, and portfolio management strategies essential for navigating the dynamic landscape of equity markets.

Equity investment imparts knowledge on the following-

- Market Organization & Structure

- Security Market Indexes

- Market Efficiency

- Overview of Equity Securities

- Company Analysis: Past and Present

- Industry and Competitive Analysis

- Company Analysis: Forecasting

- Equity Valuation: Concepts and Basic Tools

4. Fixed Income (11-14%)

Delve into the world of fixed-income securities, exploring valuation methodologies, yield spreads, and risk analysis to make informed investment decisions.

With Fixed Income analysis, you shall learn to be proficient with the following chapters-

- Fixed-Income Instrument Features

- Fixed-Income Cash Flows and Types

- Fixed-Income Issuance and Trading

- Fixed-Income Markets for Corporate Issuers

- Fixed-Income Markets for Government Issuers

- Fixed-Income Bond Valuation: Prices and Yields

- Yield and Yield Spread Measures for Fixed-Rate Bonds

- Yield and Yield Spread Measures for Floating-Rate Bonds

- The Term Structure of Interest Rates: Spot, Par, and Forward Curves

- Interest Rate Risk and Return

- Yield-Based Bond Duration Measures and Properties

- Yield-Based Bond Convexity and Portfolio Properties

- Curve-Based and Empirical Fixed-income Risk Measures

- Credit Risk

- Credit Analysis for Government Issuers

- Credit Analysis for Corporate Issueres

- Fixed-Income Securitization

- Asset-Based Security (ABS) Instrument and Market Features

- Mortgage-Backed Security (MBS) Instrument and Market Features

5. Quantitative Methods (6-9%)

Master quantitative concepts such as discounted cash flow, statistical analysis, and regression techniques, empowering you to analyze financial data with precision and accuracy.

Quant talks about the below-mentioned items, but before you go through the list check our recent article if you’re someone who is also a little afraid of numbers!

- Rates and Returns

- Time Value of Money in Finance

- Statistical Measures of Asset Returns

- Probability Trees and Conditional Expectations

- Portfolio Mathematics

- Simulation Methods

- Estimation and Inference

- Hypothesis Testing

- Parametric and Non-Parametric Tests of Independence

- Simple Linear Regression

- Introduction to Big Data Techniques

6. Corporate Issuers (6-9%)

Understand the fundamentals of corporate governance, capital budgeting, and financing decisions, vital for evaluating investment opportunities and maximizing shareholder value.

CFA Level 1 Subject corporate finance covers-

- Organizational Forms, Corporate Issuer Features, and Ownership

- Investors and Other Stakeholders

- Corporate Governance: conflicts, Mechanisms, Risks, and Benefits

- Working Capital and Liquidity

- Capital Investments and Capital Allocation

7. Economics (6-9%)

Explore the principles of micro and macroeconomics, examining market structures, monetary policies, and their impact on global economic landscapes.

Here the following topics are touched upon-

- The Firm and Market Structure

- Understand Business Cycles

- Fiscal Policy

- Monetary Policy

- Introduction to Geopolitics

- International Trade

- Capital Flows and the FX Market5

- Exchange Rate Calculations

8. Portfolio Management (8-12%)

Learn the essentials of portfolio construction, risk management, and incorporating environmental, social, and governance (ESG) factors into investment strategies.

This subject teaches students about-

- Portfolio Risk & Return: Part 1

- Portfolio Risk & Return: Part 2

- Portfolio Management: An Overview

- Basics of Portfolio Planning & Construction

- The Behavioral Biases of Individuals

- Introduction to Risk Management

9. Derivatives (5-8%)

Navigate the complexities of derivative markets, from understanding option valuation to utilizing derivatives for effective portfolio hedging and risk management.

The second last in line entails the following-

- Derivative Instrument and Derivative Market Features

- Forward Commitment and Contingent Claim Features and Instruments

- Derivative Benefits, Risks, and Issuer and Investor Uses

- Arbitrage, Replication, and the Cost of Carry in Pricing Derivatives

- Pricing and Valuation of Forward Contracts and for an underlying with varying Maturities

- Pricing and Valuation of Future Contracts

- Pricing and Valuation of Interest Rate and Other Swaps

- Pricing and Valuation of Options

- Option Replication Using Put-Call Parity

- Valuing a Derivative Using a One-Period Binomial Model

10. Alternative Investments (7-10%)

Explore the diverse world of alternative assets, including hedge funds, real estate, and commodities, to diversify investment portfolios and mitigate risk.

Lastly, with alternate investments, you shall learn about-

- Alternative Investment Features, Methods, and Structures

- Alternative Investment Performance and Returns

- Investments in Private Capital: equity and debt

- Real Estate and Infrastructure

- Natural Resources

- Hedge Funds

- Introduction to Digital Assets

Overwhelmed with the syllabus content?

Don’t worry Finelite offers a flexible study program that combines top-notch CFA Coaching with practical skills training, by keeping students’ convenience a priority!

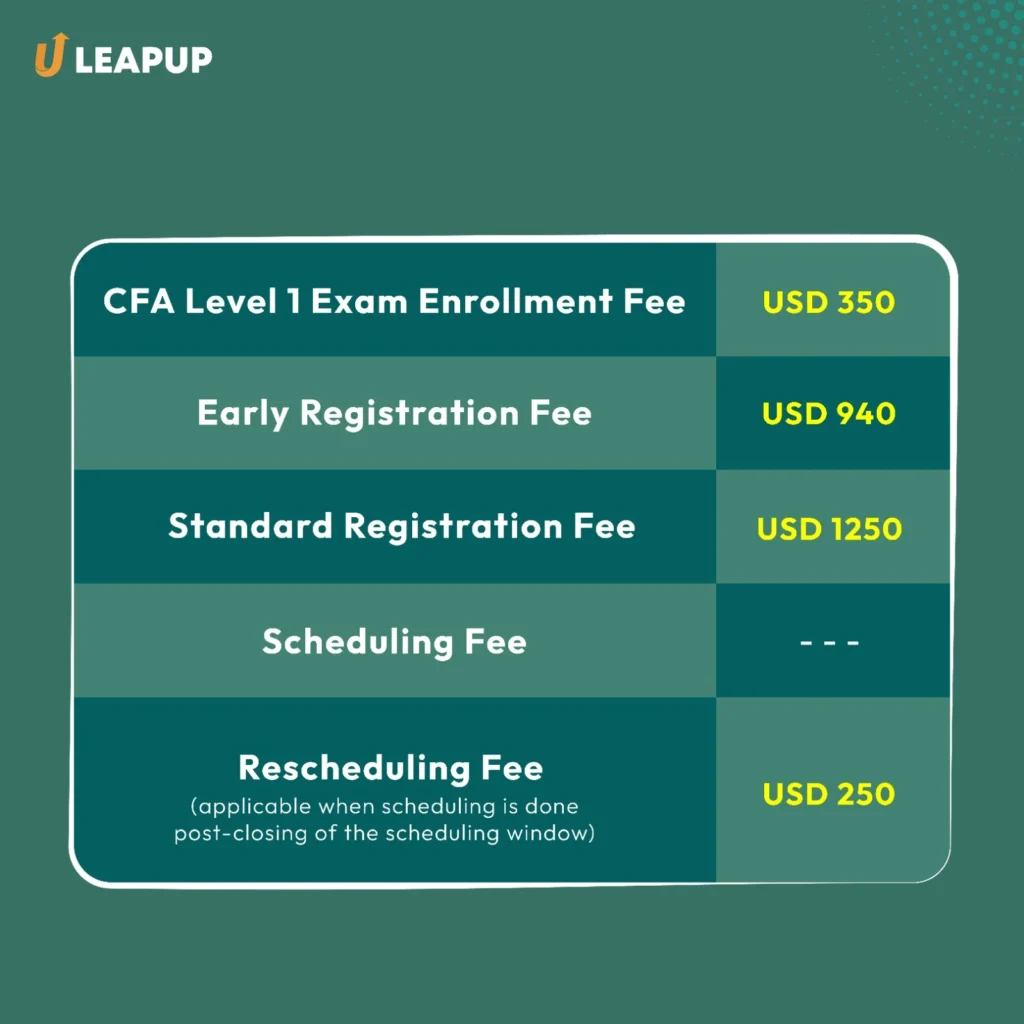

Till now we have got a detailed overview of CFA Level 1 subjects, and the next question that might come up in aspirants’ minds is- how much it’s going to cost?

Before you start googling and piling on more tasks for the Crawler, here is the CFA Level 1 Exam Fee Structure-

CFA Level 1 Exam Fee Structure

CFA Level 1 Exam Fees

Final Words!

Congratulations!

You’ve made it to the end of this guide to understanding the CFA Level 1 curriculum- a crucial step in the CFA Journey. Now you have a clear roadmap on how to navigate through the curriculum with ease.

Being a finance student myself, I can vouch for the significance these subjects hold.

Every module strengthens the backbone of financial analysis and decision-making, lessening the complexities of markets.

Remember, mastering these subjects not only prepares you for the CFA Level 1 exam but also equips you with invaluable knowledge essential for a successful career in finance.

And now comes the best part- the goodie we promised- Free CFA Decoded Webinar which answers all queries related to the subject. Imagine all your doubts solved in one place by our expert mentor who has years of experience in training young minds like yours!

Lastly, don’t forget to check the FAQ section for more insights.

Keep exploring, keep learning, and soon you’ll be well-prepared to conquer the challenges of the CFA Level 1 examination. Happy studying!

FAQs - Frequently Asked Questions

To sit for the CFA Level 1, one needs to satisfy at least one out of three following requirements-

1. Holds Bachelor’s degree or equivalent program.

OR

2. Undergrad students with 2 years remaining in their degree completion can sit for CFA Level 1, however, one needs to finish the degree program before taking CFA Level 2.

OR

3. One must have about 4000 hours of experience or higher education acquired over 3 years before registering for the Phase 1 Exam. Ensure that work experience and education timelines don’t overlap.

The course typically takes 2 to 3 years to complete

There are three levels in the CFA exam.

Level I is offered four times a year in February, May, August, and November.

Level II is offered three times a year in May, August, and November.

Level III is offered twice a year in February and August

The Level 1 exam is in a multiple-choice questions (MCQ) Format.

Exam results are typically available within 60 days of taking the exam.

Each session of the exam lasts for 2 hours and 15 minutes.

Only multiple-choice questions are included in the CFA Level 1 exam.